The Ultimate Guide to Burden Rate Calculation for Labor & Overhead Costs

What Is Business Overhead?

Let’s explore the fundamental definition of business overhead and how it operates.

Understanding Overhead in Business Operations

Business overhead refers to the essential operational expenses of a business that do not directly contribute to producing goods or providing services. Business overhead costs are recurring and remain constant, regardless of whether the corporation grows.

Key Takeaways About Overhead

Overhead is a recurring and predetermined enterprise expense that is not directly related to product creation. To maximize your corporation's profits and Revenue, carefully calculate manufacturing expenditure. Company overhead costs can be further segmented.

Overhead vs. Operating Expenses: What's the Difference?

Overhead expenses are indirect charges that keep your company running but are unrelated to any specific service or product, like utilities and rent. On the other hand, operating expenses involve both direct and indirect charges.

Our Partners

How to Calculate Overhead Costs?

Here, we will learn how to utilize the total overhead cost calculator for better effects:

Introduction

As a business owner, it is your responsibility to understand the burden rate as it determines the actual expenses of your labor. Most companies commit the mistake of only calculating direct wages and overlooking the additional costs related to other overheads. Calculating the labor burden will ensure many benefits, like efficient budgeting, fair pricing, and better financial approaches. Most importantly, your financial planning will be soulful and advantageous for the company. In this step-by-step guide, we will understand what a burden rate is and how its calculation can help businesses access detailed labor and overhead expenses.

Use This Formula for Overhead Cost Calculation

Many entrepreneurial firms consider that only diversifying their project numbers is enough to garner the attention of the market. But do you know that to ace your position as a leading company, you need to be assured of your financial predictions? So, before planning any project, you need to thoroughly calculate your labor burden along with overhead expenses to make your company profitable. You can do this through an authentic burden rate calculator available online. Both these metrics are essential to calculate as these are tied further to acknowledge your break-even rate, billing rates, and other aspects.

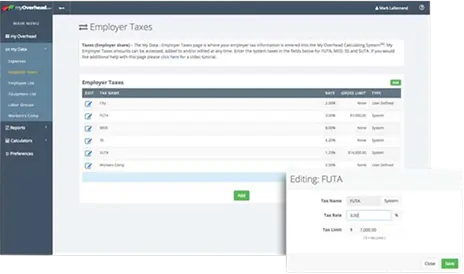

Get started today in three simple step

Start with Entering Info

Import your Profit & Loss Statement from your accounting system or simply enter from our questionnaire or data entry form

Allocate your Costs

Allocate all your costs into the correct division of your company so our system can determine your exact cost and rates

Adjust to Ensure Profits

Our system will show you exactly which services or products are profitable and what price points are needed if they are not

What Is a Burden Rate?

A burden rate mainly amplifies the indirect costs related to producing or offering a service or product. Most comprehensive businesses carry out burden rate calculations to compare indirect and direct expenses and estimate how much it costs in total to avail of their services. These costs mainly involve payroll—insurance, taxes, benefits, etc. With the calculation of the labor burden rate, you can make informed decisions about profitability, pricing, and management.

Direct Costs vs. Indirect Costs

When we talk about direct costs, these are charges directly related to the service and production of a company. This includes salaries, wages, materials, supplies, etc. On the other hand, indirect costs are the expenses that support the operations of a business. However, they are not directly associated with any particular project. Some of its significant examples include payroll taxes, employee benefits, utilities, rent, etc.

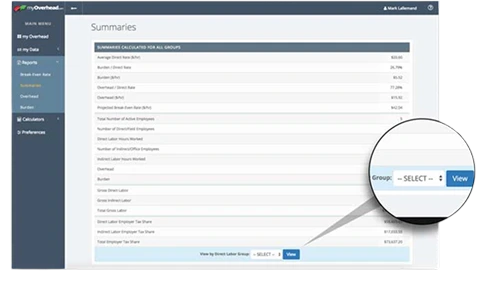

Easily Calculate (all) your

Business Hourly Rates...

OVERHEAD RATE

All Overhead Costs Including Rate Per Hour, Percentage of Labor and Annual

All Break-Even Costs Including Rate Per Hour | Week | Month | Annual and Sales Revenue

LABOR BURDEN RATE

All Labor Burden Costs Including Rate Per Hour, Percentage of Labor and Annual

LABOR GROUP RATE

All Business Numbers can be broken out by Divisions | Crews | Departments or any way you Require.

PROFIT MARGIN RATE

All Profit margin totals, annual, percentages and the most important, your profit per hour rate

SELLING RATE

How much you need to charge per hour to recover all operational costs with your profit margin included

How to Calculate Labor Burden Rate?

A thorough calculation of labor burden and labor overhead is crucial as it plays a significant role in analyzing all employment expenses. This will further help your business set competitive prices and manage budgets effectively with better operations. For your reference, we have mentioned the calculation method here, along with a real-life example.

Labor Burden Rate Formula

To calculate your labor burden rate, you need to use this formula:

Labor Burden Rate (Total Indirect expenses/Total Direct labor expenses) x 100

The following formula allows a business to understand the additional charge percentages that are used beyond the direct wages.

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

Example Calculation

Calculating Labor Burden Rate

A company has direct labor costs of $500,000.

Indirect costs include:

- Health Insurance: $30,000

- Payroll Taxes: $50,000

- Workers' Compensation: $20,000

- Facility Costs: $25,000

- Training Costs: $25,000

Total Indirect Costs:

$30,000 + $50,000 + $20,000 + $25,000 + $25,000 = $150,000

Labor Burden Rate Calculation:

500,000150,000×100=30%✅ Result: The company's Labor Burden Rate is 30%, meaning for every $1 spent on direct labor, an additional $0.30 is incurred in indirect costs.

Fully Burdened Labor Rate Calculation

The labor burden rate helps in verifying the percentage of your company's indirect costs. On the other hand, a fully burdened labor rate calculator verifies the total cost per hour of assigning an employee, including wages and other necessary charges. This is needed for precise cost estimation, and you can even set competitive rates

Fully Burdened Labor Rate Formula

To calculate a fully burdened labor rate, you need to follow the formula mentioned below:

Fully burdened labor rate = (Total direct labor charges) /Total hours the employee has worked.

Through this formula, you can determine the hourly charge of a labor.

Real-World Example

If a company has a total direct labor cost of around $500,000 with an indirect cost of around $ 150,000 and the total hours worked are 20,000 hours. With the formula: Fully Burdened Labor Rate = ($500,000 + $150,000)/20,000. The rate will be $32.50 per hour.

“The myOverhead System has reports that are Easy to Understand and used to Establish your Correct Pricing Structure for the Services and Products you sell“…

Overhead Rate Per Direct Labor Cost

The overhead rate is known to be a valuable metric that can help your company determine how much indirect expense has been used for every dollar spent on your direct labor. This can be a good step to boost your financial planning.

Formula & Calculation

The overhead rate per direct labor cost can be calculated through the formula mentioned here: Overhead rate = (Total overhead charges/ Total direct labor charges) x 100. So, if your total overhead costs will be $200,000 and total direct labor will be $ 500,000, the overhead rate will be 40%.

Burden Rate in Manufacturing

To calculate the burden rate in manufacturing, you need to assess the additional factors as well, like machinery maintenance, factory overhead, and production demands. The formula to calculate the manufacturing burden rate is: MBR = (Total indirect charges + Factory overhead)/ total direct labor charges x 100.

Burden Rate in Construction & Manufacturing

You must be clear about the fact that the labor burden varies from industry to industry. You can avail yourself of the construction company overhead and burden rate in manufacturing in a different manner, as given below.

Construction Labor Burden Calculation

When it comes to a construction company, the labor burden wages involve workers' compensation, payroll benefits, taxes, etc. As a business, you need to calculate the labor burden very carefully to acquire profitable aspects. You can even use a construction labor burden calculator for better effects. Construction labor burden rate = (Total indirect charges/ Total direct labor charges) x 100.

Best Practices to Reduce Labor Overhead & Optimize Burden Rates

Here, we have mentioned the best practices for you to use the calculator to get accurate employee overhead costs and labor overhead rates. Regularly Update Labor Burden Calculations Constantly update and review your labor burden calculations to verify changes in taxes, wages, and other benefits. This will make you ensure precise cost assessments and better planning. Optimize Overhead Expenses Be aware of your indirect and direct overhead costs and accordingly cut down on unnecessary expenses. For example, you can take administrative charges and allocate resources ineffectively.

How to Use a Burden Rate Calculator

You can avail of any burden rate calculator online to understand your burden rates for labor. This can help your business determine authentic labor charges by assessing factors like payroll taxes, wages, benefits, and direct labor overhead expenses. You have to input these costs, and the following calculator will automatically generate the total labor rate and depict accurate project budgeting.

Implement Efficient Workforce Planning

Make sure to enhance your productivity levels by managing shift schedules and leveraging automation. This will help you save the labor costs. Use Fully Burdened Labor Rate Calculators You can effectively use a comprehensive, fully burdened labor rate calculator to authentically predict labor charges that involve benefits, wages, and overhead.

Give our users a great experience

Frequently Asked Answered.

What services does MyoverHead provide?

With our easily accessible overhead allocation calculator, you can estimate your break-even rate, labor burden rate, labor group rate, selling rate, and profit margin rate. Analyze your budget and accordingly simplify the financial planning.

How does MyoverHead's business overhead calculator work?

Our overhead-applied calculator helps track expenses by analyzing your budget. Just import all your latest data and allocate the costs to divide the charges correctly. Now, the calculator will showcase the exact details.

Is MyoverHead's overhead cost calculator free to use?

Yes, it is completely free to use our MyOverhead calculator. Corporations must provide their expenses, and the calculator will automatically analyze the costs and financial planning for better business goals.

How do I calculate my business's overhead costs?

To calculate your overhead in estimation and Costing, you need to analyze your total variable, fixed, and semi-variable expenses. Then, using the total overhead expenses/Total Revenue) x 100 formula, you can determine the expenditure percentage.

What is the difference between overhead and operating expenses?

Overhead expenses can be your indirect expenses, such as utilities and rent. On the other hand, operating expenses involve direct and overhead expenses like company essentials, raw materials, wages, and daily operations.

How do overhead costs impact pricing and profitability?

If the overhead expenses are higher, it can increase the pricing demands of your corporation, and your profitability may be hampered. So, you need to do online overhead calculations, manage your budget, and lower the expenses.

What factors contribute to high business overhead costs?

Some factors that affect the business overhead expenses are operational inefficiencies, excessive expenses, ineffective financial planning, careless spending, and lack of proper scalability. So, you need to manage these factors with a small business overhead calculator.

How can I reduce my overhead costs without affecting quality?

You can reduce overhead expenses by proper operations, auditing expenses, automating tasks, and outsourcing non-core activities. You can also use our total manufacturing overhead cost calculator to optimize expenses.

How does overhead affect break-even analysis?

Higher overhead can maximize your break-even point, which demands more sales to cover the expenses. However, with lower overhead, you can lessen the break-even threshold through which you can access profitability.

What are the best ways for small businesses to control overhead expenses?

Small companies can control their overhead using a total manufacturing overhead cost calculator. This will help them track their expenses and take steps like outsourcing, automation, negotiation with vendors, etc.

Get in Touch

Have a question for us?

Need expert advice or have a question? We’re here to help! Reach out to us, and our team will get back to you as soon as possible.

Optimize Your Business Costs!

Understanding your Labor Burden Rate helps you make informed financial decisions, improve project pricing, and maximize profitability. Start analyzing your labor costs effectively to ensure smarter budgeting and long-term business success.